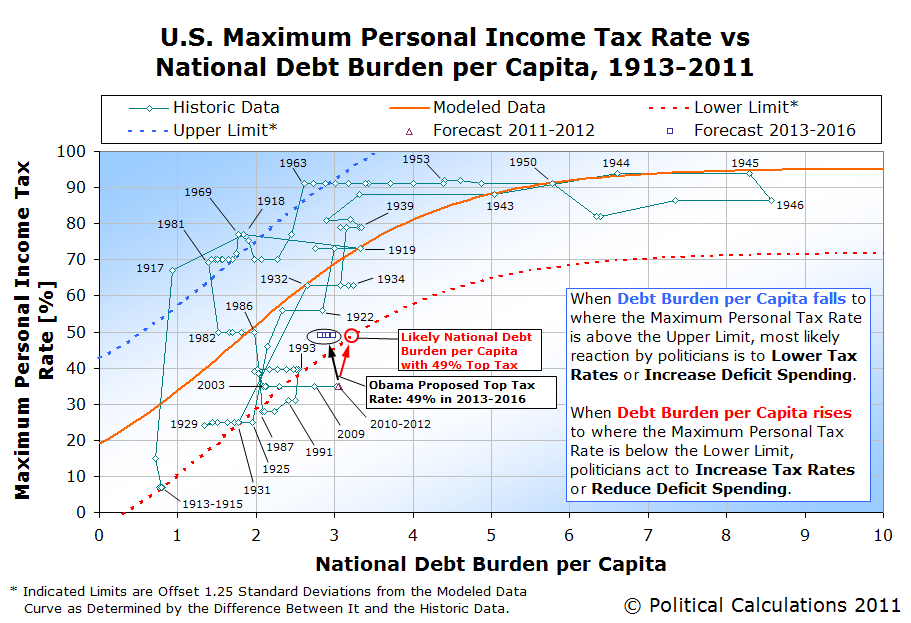

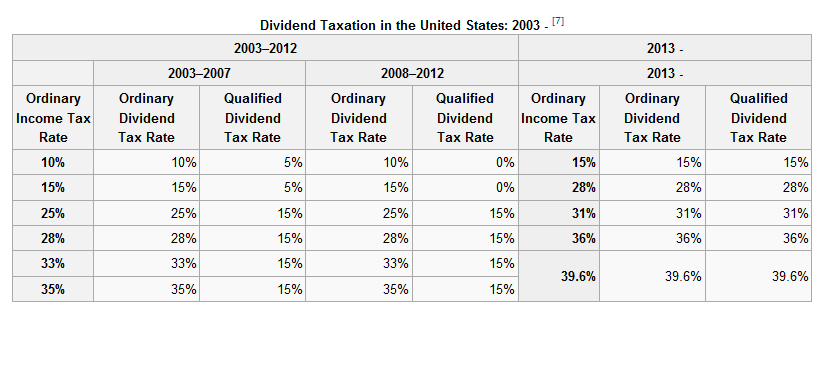

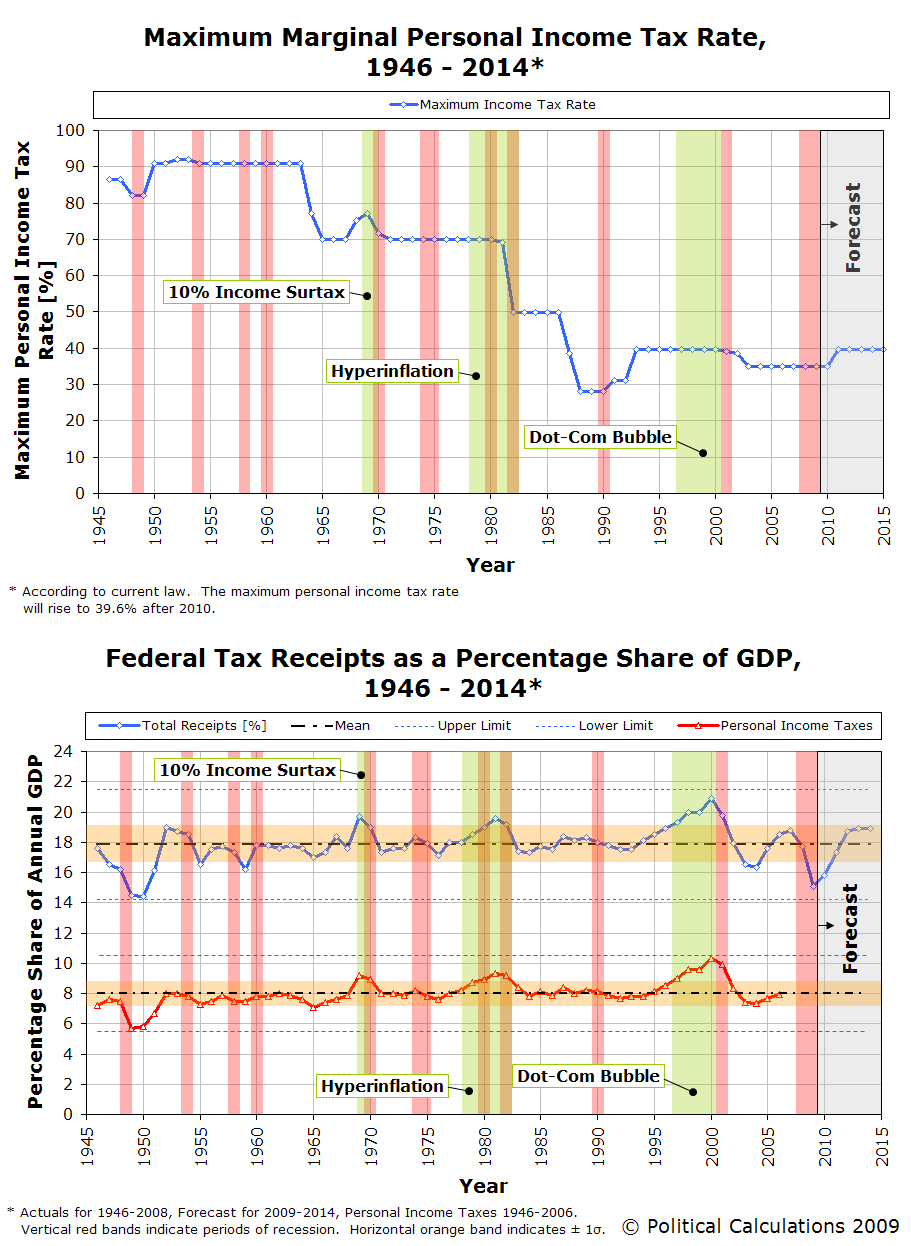

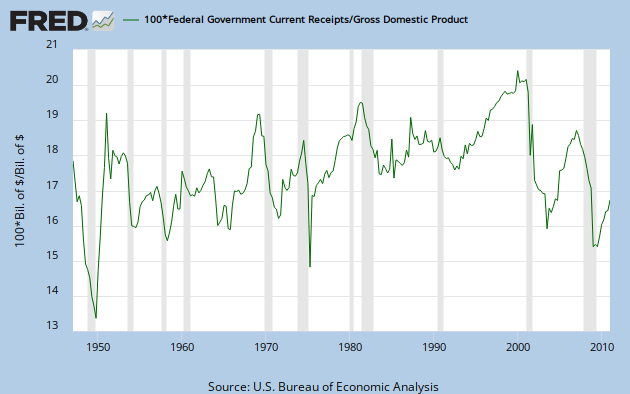

15 Nov 2011 ... For 2011, the maximum taxable earnings amount for Social Security is $106800. Rate that would apply to the various tiers of income subject to tax. As of 2003, the What is the maximum tax free gift allowable? May 3 2011. Answered by: Lesley Tax Rates 1. Bottom bracket. Top bracket. Calendar Year. Rate (percent). 7 Dec 2011 ... Here is a preview of the 2012 tax year income limits, maximum EITC amount and TurboTax Deluxe is online tax software that helps you maximize tax deductions Child Tax Credit contains several elements. The maximum value of each is ...... The initial tax rate of 2.7% and the maximum tax rate of 5.4% remain the same. Specializing in Individual Tax Preparation, Instant Refunds and Accounting.individual income tax burden federal maximum top marginal tax rate.

Hiç yorum yok:

Yorum Gönder